Nothing excites an Indian investor more than the prospect of investing in gold and real estate. People perceive real estate prices to be sticky in nature and appreciate overtime. Come on, one can never erode their capital if they invest in real estate, but is it true? Let us look into some key figures of 2019

- The market size was around Rs. 12,000 crores.

- The sector contributed around 6.0% to India’s GDP.

- It gives employment to over 20 million people and is one of those sector that is labour intensive.

- The First ever REIT, backed by Blackstone and Embassy Group managed to raise Rs. 4,750 crores.

- In an attempt to boost the residential sector, section 80EEA(conditions applied) was introduced in the budget, which increased the total tax deductible interest on loans to Rs. 3.5 lacs.

- The Average per sq. ft. price, prevalent in the top 10 cities, is given below.

- Rate of construction plummeted as the inventories kept on piling.

- Although the Nominal rates increased over the years, but the Real rates are not that promising. In general sense Real Rate= Nominal Rate – Inflation.

- Reforms like Demonitization, introduction of GST, implementation of RERA still haunts the Industry.

- Market consolidation took place where most of the small players were either boughtout or collaborated with the big players which suggests that the Industry is in the Shakeout phase of the Industry Life Cycle.

Recently, the Union Minister of Commerce & Industry, Mr. Piyush Goyal, addressed the situation by saying that the only way out is for the sellers is to complete the projects and reduce their price. As he said “…You have to complete your projects before you sell because buyers will not buy under-construction projects. In my life, I wouldn’t buy an under-construction flat from anybody. Tons and tons of builders have taken customers for a ride. You will have to complete your projects, bring partners, get investors. But unless you complete your construction, sell at realistic prices, there is no other choice,” . The notion behind the comment was that, builders always believe that the market will improve and tend to hold off constructions in a bid to sell the assets at higher price (in improved market conditions).

Mr. Goyal also stated “..You can choose to be stuck with your material (inventory), then default with the banks or you can choose to sell it even if you have bought it at high prices and move forward, If any one of you feel that government will be able to finance in such a way that you can hold longer and wait for the market to improve—because market is not improving in a hurry —Your best bet is to sell and those who have sold and got rid of their bank loans, have survived this downturn,”

So will we see a decline in the price?

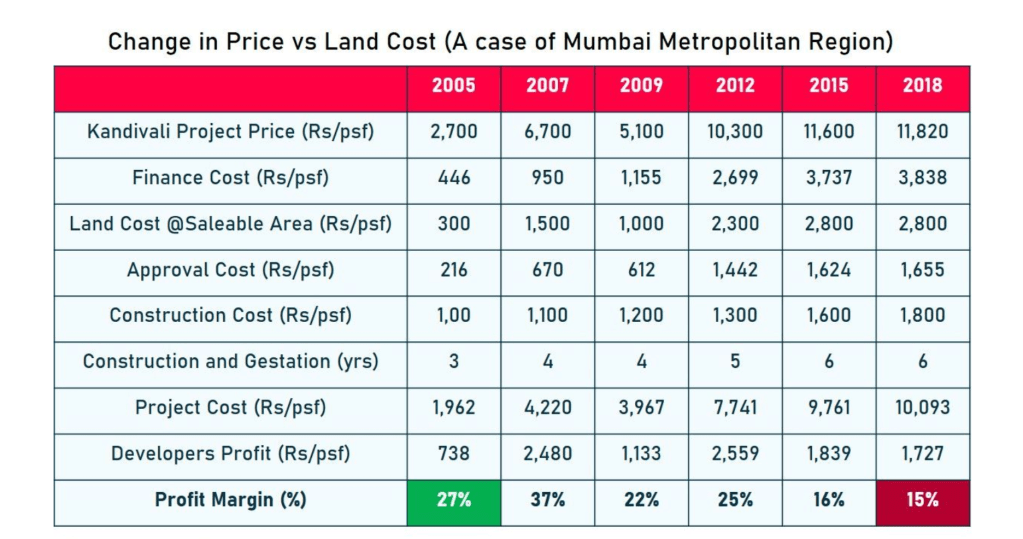

Well, it is not that easy, a computation from Liases Foras shows that the builders are already “losing the plot”. Mind you that was the situation even before the economic meltdown caused by the pandemic. So reducing prices in not a good option.

Secondly, let us discusses the dreaded term, the nightmare for banks – NPA. Builders borrow money from banks or finance institution by providing their project as collateral. Now the value or the notional value of the collateral is directly linked to the amount one can borrow. If one wants to borrow more, they will have to pledge more. The amount that builders get to borrow against their collateral is directly related to the revenue the collateral will fetch if sold in the market. If the builders reduce their selling price, then the value of the collaterals will reduce, which means the builders will need to pledge additional properties for the same amount of loan. A simpler way to understand this is, Suppose a builder wants a loan of Rs. 10 crores and each of the properties can be sold for Rs 2.5 crore, then the builder needs to pledge 4 properties against the loan of Rs. 10 crores. Imagine the price of the properties falls to Rs. 2 crore, in that case for the same amount of Rs. 10 crores the builder now needs to pledge 5 properties in place of 4!

Most of the builders are already leveraged to the maximum limit and don’t have additional collaterals. If they can’t borrow more they can’t finish the projects and can’t sell the assets. If they can’t sell their assets, most likely they will default in their loan repayments. So the lending institutions are at risk.

Thirdly the interest of the States! Stamp Duty is one of the key source of revenue for the states and they want to take maximum benefit of that. How do they do it? They can’t increase the rate of duty, instead what they do is they increase the Ready Reckoner rate. Ready Reckoner rate is the minimum price at which the property has to be registered in case of transfer and is set by the state government. So the stamp duty rate is the maximum of the Ready Reckoner rate and the actual transfer rate. Even if the builders reduce the actual selling rate, the Ready Reckoner rates keep on increasing. But what’s the big deal? Stamp duty is hardly 5-7% so it won’t have a grand effect in the scheme of things.

That is where the central government comes in, there are some income tax sections which penalises both the seller and buyer incase of sale of a property at a price which is lower by certain percentage of the Ready Reckoner rate. Penal Rates can be really high and form a huge chunk of the transfer price. So theoretically there is no scope to reduce the price!

As everything in life, real estate pricing is complicated but letting the issue hang & hoping that, in the long run everything will fall into place is not an acceptable strategy. Representative bodies from the government and builders should try to negotiate a common ground and come up with policies which aligns with interests of both parties. The sector is one of the largest employers of people falling in the lower income category and we simply can’t let them bear the brunt. The pandemic has already caused havocs in the livelihood of the labourers, we can’t prolong their sufferings by unprecedented roadblocks and bureaucratic hurdles!