On 15th July 2020, Apple won a four year long battle against the European Union’s Antitrust Regulators and got away from paying €13 Billion as taxes to the Irish government. Let us roll back the years and look at the events that led to this landmark judgement.

The year was 1991 and Apple wanted to expand their market beyond North and South America. While operating out of America was ideal for this home grown brand, the problem was, as per USA tax law they had to pay an effective tax rate of 35% on their profits. Then they discovered Ireland! A country where the effective corporate tax rate was just 12.5%, almost 1/3rd of what they had to pay back home. But wait there is more. Ireland has a strange law in place when it comes to taxation. According to the law, if an entity set up in Ireland is controlled by managers situated elsewhere, then the profits of such entity will be taxed in the jurisdiction where the management is situated!

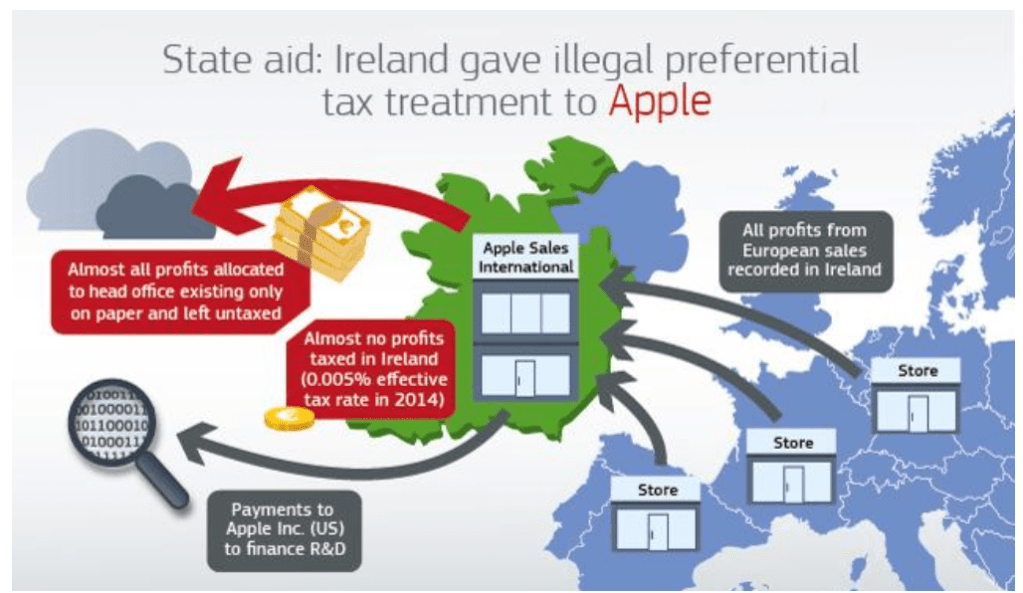

That’s confusing? Well let me take an example, in 1991 Apple sets up two subsidiaries in Ireland namely Apple Sales International and Apple Operations Europe. These companies were given the right to use Apple’s intellectual property to sell and also manufacture Apple products outside North and South America. The agreement had a stipulation which stated that these companies functioned on ‘cost-sharing agreement’ with Apple Inc and also financed the R&D activities of the parent company situated in America. The management or the head office of these companies, that only existed on papers, was in a tax heaven country like cayman islands.

Apple Sales International was responsible for sales in Europe, Middle East, Africa and India. As a result of which revenue was booked in Ireland hence profits were to be taxed in Ireland. Apple Sales International allocated most of profit to its head office which was situated in a tax heaven country. This accounting treatment meant that such profits were not to be taxed in Ireland but in the country where the management was situated, which happened to have a nil tax rate as it was a tax heaven country! in 2011 Apple Sales International recorded profits of €16 billion. They diverted or showed €1.45 billion as R&D expense paid to parent company and €14.5 billion as expense attributable to the head office. Hence their taxable income in Ireland turned out to be €50 million (€16 billion-€1.45 billion-€14.5 billion), on which they paid the income tax. This whole arrangement meant that they paid an effective tax rate of 0.05%. This rate fell down to around 0.005% in 2014 as revenue increased but profits in the books decreased.

This set alarm bells as in July 2014 as the European Union’s competition commission intervened and protested that Apple was getting undue favours from the Irish government. They claimed that head office didn’t have its own premises nor did it have any employees which meant that head office was incapable of generating such high revenues and this entire arrangement was a farce to evade taxes. They challenged that the transaction between the various entities should be deemed as transfer and valued at arms length ( as if the transaction took place between two independent parties and valued as per transfer pricing rules). The EU rules are clear when it comes to preferential treatment which constitutes to be state aid. Such arrangements distort competitions as it gives economic advantage to a particular organisation. So an order was passed asking Apple to pay €13 billion as taxes (including interest)

Apple, was not about to give away so easily without fighting! They went to court and rebuked the claims made by the commission. Tim cook went on to say that the entire thing was just political crap. The case raged on for 4 years and finally on 15th July 2020 we got the verdict. General court of European Union said that “the Commission did not succeed in showing to the requisite legal standard that there was an advantage” for Apple. In simpler terms it meant that it couldn’t be proved that Irish government had given Apple any added benefit or preferential treatment hence they were awarded a clean chit!!

Few things to ponder…why Ireland has such rules where it misses out on tax revenues? Well, such policy actually attracted the giants like google, which lead to employment in Ireland.

How can such gaps be plugged? In our last answer we have used the word “attracted”, past tense, as in 2015 “Controlling Foreign Corporation” regulations came into force. As per this regulation, any US entity having such arrangements to avoid taxes, would be forced to pay taxes in US.

As to the judgement, well we think that Apple was street smart and functioned within the legal boundaries. Whether they functioned within the moral boundaries is a different question. Using accounting treatment to manipulate books is an old age technique and one made famous by Enron. Sometimes loopholes are left in the system, not as mistakes but purposely in order to attract the giants. Apple just milked the cows and made most of it!