As an investor, we rely heavily on the authenticity of the financial statements while making investment decisions. The amount of trust and faith that we put in an auditing firm is humongous. We expect the firms to maintain integrity and perform their duties diligently. The problem arises when the non-auditing services clash with the auditing services. Auditing frauds are quite famous, may it be the case of Enron, where it leads to the dissolution of Arthur Andersen or Satyam which, leads to placing the onus on the auditors and levy of harsh penalties

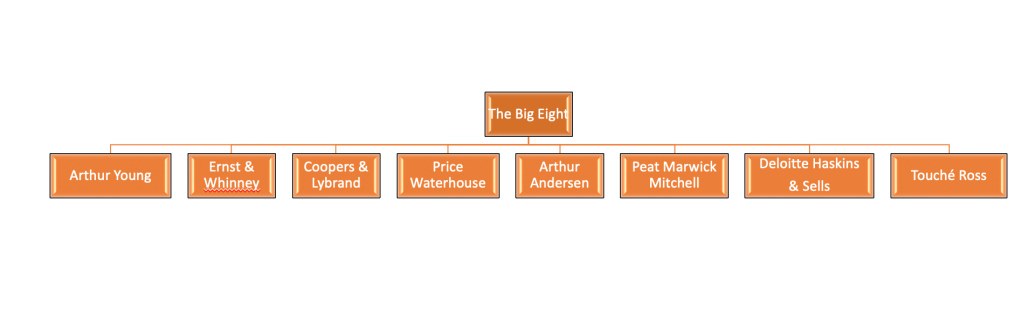

Let us look at the evolution of the firms. In 1970s and 1980s the industry was dominated by 8 firms

As is the case with most industries, consolidations took place and as most expanded few of them merged to form new dominant entities. The position as on 1989 was.

Finally in 1998 The Big Six became the Big Five.

After the collapse of Arthur Andersen, we were left with the Big Four. Their dominance just kept on increasing, together they have captured more than 75 % of the global account market. Which is a staggering 10% increase from the year 2018 and their revenue stood at $154 billion (in 2019).

Still not convinced about the scale of influence these firms have on the retail investors? Only 5 out of the 500 S&P global companies are audited by non-Big Four firms! It’s not only the American market, their dominance extends worldwide. in UK, all 100 companies of FTSE 100 index are audited by Big Four.

Critics argue that too much power is vested in the hands of few and the system needs a shakeup. It can be pointed out that despite their vast resources and over a million employees there have been growing instances of negligence. Lehman Brothers were audited by Ernst & Young which didn’t say anything about the deteriorating credit standards which might affect the going concern assumption (one of the fundamental assumption). The 1Malaysia Development Berhad scandal tainted three of the Big Four. Even Thomas Cook was audited by PWC and EY.

Closer to home in 2020, when Wirecard AG, an online payment company filed for insolvency, the German regulators scrutinised EY who were the auditors of the company for over a decade. Apart from auditing the firms provide service of management consultancy, market research, taxation and consultancy services. The non auditing services form the lion’s share of the income, statistics reveal that only one-fifth of the total revenue comes from auditing services. Critics say that it has impacted the robustness and objectivity of the firms auditing commitments as they don’t want to scrutinise their client’s business because the fear of losing elite client is greater than adhering to morale.

Just to give you an idea, a case study was conducted on 2700 companies spanning over 125 countries from January 2016 to October 2017. All these companies were under scrutiny from regulators for accounting fraud. It was surprising to see that in over 40% of the cases frauds were detected via whistleblowers and only 16% of the cases were detected by internal auditors and 4% by external auditors.

The Big Four argue that there are enough checks and regulations in place to ensure the independence of their audits. They say that the Sarbanes-Oxley Act of 2002, Japan’s Financial Instruments & Exchange Act, etc are sufficient to keep their opinion unbiased and just. In UK & EU auditors are not allowed to provide consulting services one year leading up to and during the term of an audit contract. Companies in the FTSE 350 index must put their audit for tender every 10 years and change their auditors every 20 years. But when an auditing contract ends the firm can immediately start providing consultancy services to the same company thereby making it less likely for the auditors to challenge a client if it jeopardizes the firm’s prospect of lucrative non-audit work.

Facts show that even with complex laws, longer annual reports, and harsher penalties, the number of frauds has not reduced. We can place checks and enforce laws but nothing can change the intentions. No law can enforce morality. One way to get around is to introduce some sort of caping fees where the audits become a more lucrative prospect. But that’s easier said than done. Deloitte has set up a governance body to look after the audit adherence and quality but we don’t know whether it will help or is just an eyewash, only time will tell…Unless the industry can build confidence that their audit is independent, objective, and uncompromised the pressure will build on the regulators to act before the financial world is engulfed with another major accounting scandal. With the pandemic taking a toll on the economy, we certainly don’t need the collapse of a huge conglomerate that will further destabilize the markets!