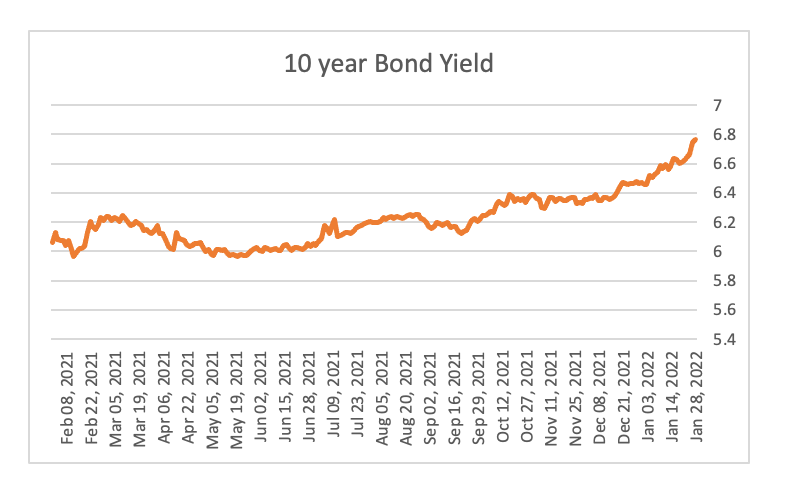

The 10-year government securities (G-Sec) bond yield was 6.768 as of January 28,2022 while the lowest yield over a year’s lookback period was 5.962 as of February 11, 2021. The yield has been on the upward move (as shown in the graph). The yield of 10-year G-Sec is considered a benchmark and it reflects the overall interest rate scenario of the country.

let’s start by explaining what is a bond. As per Investopedia “A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental)”. Just like equities, bonds can also be listed and traded on an exchange. A company issues bonds to raise money from and they pay regular fixed interest called coupons to the bondholder, however, there can be zero-coupon bonds as well that don’t pay any coupon. The issue price of the bond is known as the face value and the coupon is calculated on the face value. The bond is generally issued for a fixed time period (yes, there are callable bonds as well, but let’s keep it simple for the moment) known as the term. The zero-coupon bonds are issued at a value lower than the face value and on maturity, the holder gets the face value.

Just like the dividend yield is calculated as the dividend amount divided by the traded price of the stock, the bond yield is computed as the coupon payment divided by the traded price of the bond. Suppose you buy a 10-year bond worth INR 20,000 with a coupon rate of 5 percent, therefore you will earn INR 1,000 per year. Imagine the traded price of the bond falls to INR 10,000, then your bond yield will be 1,000 divided by 10,000 which is 10%.

As one can see the yield is inversely related to the bond price. A higher yield means a lower bond price and vice versa. The onset of the third wave, slowdown of recovery in most of the sectors, and rising inflation have led to a decrease in bond price and increase in yield.

Ideally, a rising bond yield will make investing in bonds more attractive as compared to equities, as bonds tend to be less risky compared to equities. In practice, investors don’t just look at the yields in isolation. They also look at the factors driving the yield. Most of the time there are two reasons: growth and inflation that impact the yields. Yields would rise on the back of strong growth in the economy as it indicates shows recovery or improvement. However, yields would also rise, when inflation increases. Both of these increases are perceived differently in the equity market.

When growth is strong, cash flows and future earnings prospects improve. This is perceived as a positive sign and rallies the equity market thereby offsetting any negative impact of the rising yield. So the overall impact of equities is positive But when yields rise due to inflation there is a negative impact as inflation is not a good sign and it reduces the purchasing power of money thereby impacting the equity prices negatively.

Inflation also leads to higher discount rates which lead to lower equity value. Equity can be valued in multiple ways but one of the common methods is the discounted cash flow (DCF method). In DCF the future cash flows of a company are discounted/divided by the cost of capital. An increase in yields will lead to an increase in the cost of capital which would decrease the returns thereby making equities unattractive. One can also look at bonds yield as opportunity cost. If the bonds give an attractive return then the investors will rather invest in bonds than in equities. This leads to the reallocation of funds from equities to the bond market by the Foreign Institutional Investors.

Bond yields are one of the many metrics available for economists to judge the health of an economy. It reflects the growth factor and/or the inflation. When investors expect a hike in interest rates, they sell off the bonds which lead to a further price drop and increase in yields. An increase in yield leads to a direct increase in the cost of debt for companies which puts stress on the cashflows and lowers profitability. The risk of bankruptcy and default also increases and this typically makes mid-cap and highly leveraged companies vulnerable. In short increase in yields not driven by growth is detrimental for the economy.