The P/E ratio or the price to earnings ratio measures the current market price of a share relative to the earnings per share and is fondly known as the P/E multiple. The ratio can be both backward-looking or forward-looking. P/E ratio indicated the dollar amount an investor wants to invest to get $1 of that company’s earnings. A P/E multiple of 15x means that an investor has to pay $15 to get $1 of the company’s earnings.

The P/E ratio is one of the most widely used ratios by investors and analysts to determine the value of a share relative to another. The ratio gives us an idea of whether a share is overvalued or undervalued. A company’s P/E ratio is compared with the other companies in the same industry, or against a benchmark index.

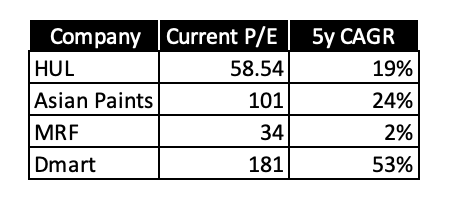

Does a high P/E ratio result in a high CAGR?

Why is it so?

Well, most of the market metrics were developed 60-80 years ago when there were hardly any service sector companies and the heavy lifters were traditional manufacturers who had huge investments in physical assets (plants and machinery) therefore their balance sheet revealed their networth or the right price (book value). However modern-day companies have moved away from the traditional investments in physical assets. Take the example of an FMCG company, their brand value will surpass its investments in physical assets. Hence the market values such companies higher than what is apparent from their balance sheet.

Is P/E still valid?

P/E can be a really good indicator but one needs to look at it in a new light. One needs to understand that the market is probably overvalued with large investments coming in and most of the Institutional Investors are operating in FOMO (Fear of Missing out) mode. One also needs to understand that the value of the company is no longer derived from its book value and the market value can deviate a lot from it. We need to understand what is driving the actual valuation. Does the company have anything that gives them a long-term edge over the competition? All said track records speak for themselves, that’s what great companies do, they survive during the downturn and thrive during the upturn. Understanding what drives the P/E is more important than looking at the ratio.