July 1 – 22, 1944, World War II was coming to an end as representatives from 44 countries met at a Hotel in Bretton Woods, New Hampshire to discuss new monetary policies that would shape the post-war era. We all know that the meeting led to the birth of the World Bank, the International Monetary Fund (IMF), and the US Dollar emerging as the “International Reserve Currency”. At that time the US controlled most of the world’s gold and they had decided to fix the value of the dollar to gold at USD 35 an ounce (the base of a non-fiat currency). Even today there are countries like Hong Kong, Jordan, Saudi Arabia, etc. whose local currencies are pegged to the US dollar.

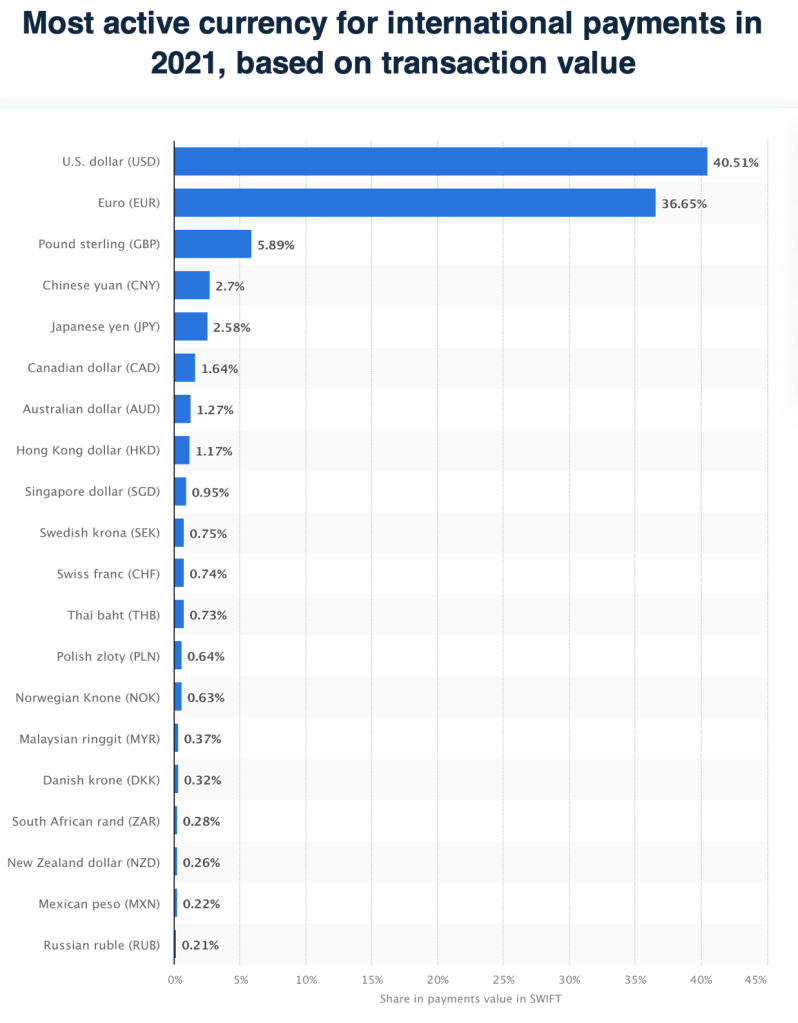

In 1971, under the presidency of Richard Nixon, the US dollar converted to a fiat currency i.e. it is no longer backed by any commodity nor can it be converted into gold. However, the dollar still remains the influential currency and all prudent central banks maintain a significant portion of their forex reserve in US dollar-denominated currency. What people tend to forget is that most of these foreign reserves are actually held with the US banking system and not in the respective central banks’ own vaults. This might seem odd but twelve years back, a famous economist (former governor of RBI) Raghuram Rajan, in his book Fault Lines: How Hidden Fractures Still Threaten the World Economy explained the rationale behind this madness. He delved deep down the hole and discovered that much of US growth is financed by the developing countries who not only supply the goods in form of exports but also provide the finance to pay off the exports by investing in US assets. This was made feasible as the US works on a debt-financed consumption model and on the credibility of the US dollar being a safe-heaven currency. US dollar is still the most used currency in the world.

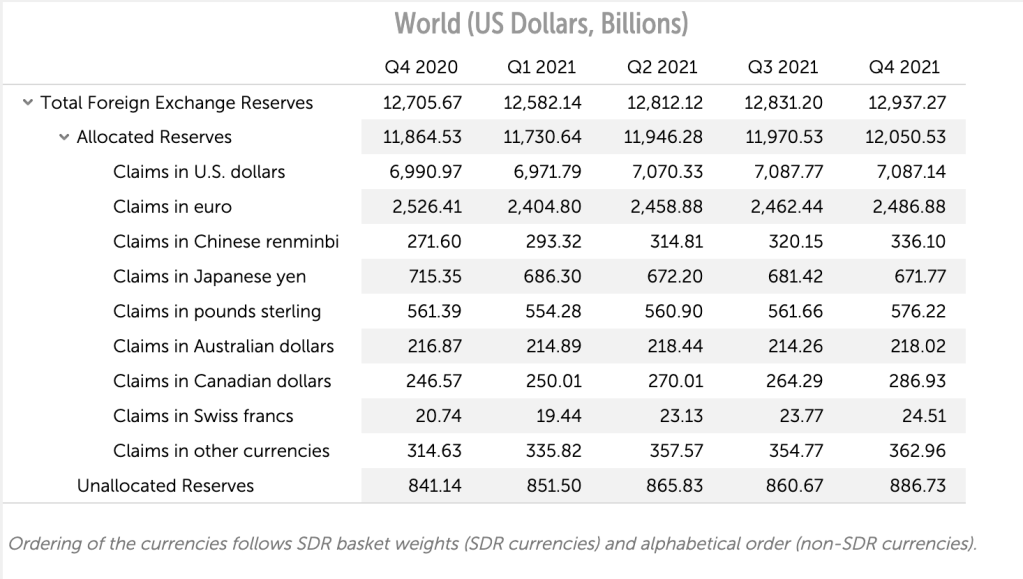

Although the central banks diversify their portfolio and invest in assets a majority of the chunk would be in euro, pound, franc, and yen.

The Ukraine war has again reinstated the fact that most of the global financial system is run primarily by the west. When the west imposes sanctions the others have to feel the pain (increase in oil prices, commodities, etc.). More importantly, Russia saw its reserve of USD 640 billion disappear in a few hours which can send shrivels down the spine of other countries, knowing the consequences of messing with the west. One needs to revisit the rationale of investing in developed countries, and factor in the consequence of assets getting frozen or being dictated by the powerful west.

In such a scenario assessing political risk becomes a key factor in making the investment decision. First of all, we need to understand why central banks maintain foreign reserves? Well, reserves are necessary to facilitate international economic transaction like imports, they are useful in times of crisis, it prevents attacks on domestic currencies, etc. But all these advantages can vanish in hours as what happened to Russia.

Well, one way to avert such a situation is to follow the golden rule of investment known as asset diversification. Many developing countries will seek to move away from the assets of the west and invest in countries that are on good terms with them. The shift may not be evident in the short run and will take time to materialize, definitely, it’s going to be a slow one. This is what Russia did when it decided to invest in gold and the Chinese renminbi. The west can counter the move by increasing their interest rates which might woo the investors but it will also lead to depreciation of these currencies thereby increasing the purchasing power of the developing countries. A lot depends on how China and other developing countries navigate the situation.

We will see a new trend emerging where the east will start forming their own alliances and trade in currencies that they perceive to be strong within their group. Already Saudi Arabia is contemplating yuan-based trade. India recently entered into an agreement to buy oil from Russia in rupees and allow Russia to invest that money in Indian bonds (the blood money). We will also see the central banks moving toward physical assets like gold (which is still the widely accepted one), however, black gold (oil) can also be the way ahead. Cryptos are volatile, and fall into that gray area as to what is legal and what is not, but who knows they can emerge as the go-to asset in the future. One can’t says with confidence that the war will dislodge the US dollar from its numero uno status but it sure highlighted the faultlines. It has revealed how the concentration of too much power in a single currency can be detrimental to those not taking an active part in world politics or maintaining a neutral stance on war scenarios.