We are going through a period of uncertainty and volatility in the market which is quite evident from the Volatility Index (VIX). The VIX measures the market volatility over the near term and to put it lucidly, the index is constructed using the Out of the Money bid-ask spreads.

These have led to mass panic amongst many investors which has been heightened with the news of some of the FDI’s leaving India. Investors want to avoid the dwindling stock market and are looking for safer bets. Many of them think that bonds with their fixed rate of coupons give them a certain cushion against the upheaval of the stock market. But is it so?

We have plotted the returns of Nifty50 vs 10years Bond. We see that while there are periods where the returns diverge and move in the opposite direction but mostly the returns move in the same direction thereby squashing the notion that “bonds are a good hedge in the long term scenario”. We have to understand one thing all asset derives their price from the economic conditions prevailing in the country. So when we are on the path of growth the price of both the equity and bond will rise, thereby moving in the same direction and vice versa.

But are bonds better in periods of uncertainty? Well, a recent report shared by Credit Suisse where they have studied the stock market across 23 developed nations for a period of 122 years shows that bonds outperform equity in periods of deflation but during inflationary conditions, the returns on bonds tend to be lower than those of equity. This is actually consistent with the Capital Asset Pricing Model (CAPM) theory where the market rewards you for taking an additional risk during periods of uncertainty.

Inflation lowers the value of the coupon interest payments. The longer the term remains to maturity the higher the effect of inflation on the price. In most cases, there is a negative relationship between interest rates and bond prices (barring a few exceptions like callable bonds)

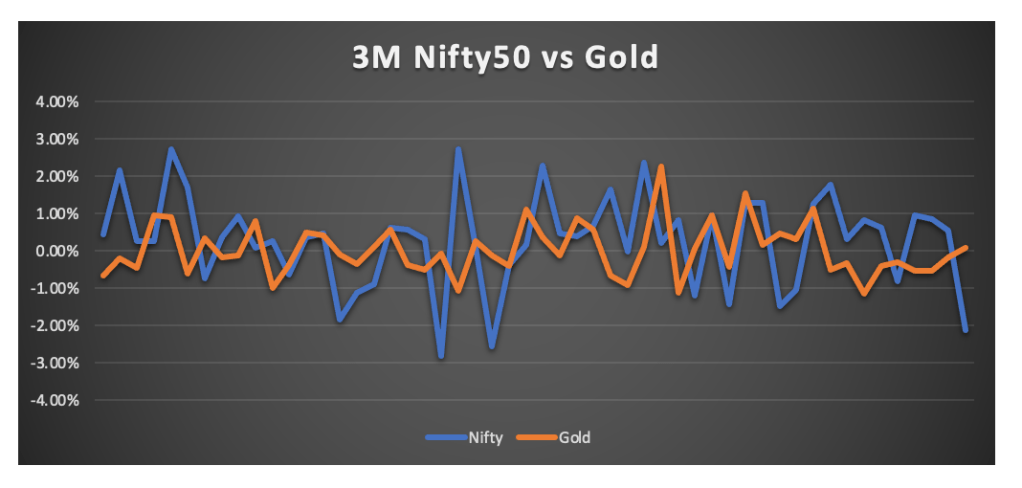

Well investing in India’s go-to asset i.e. gold won’t give you a better result than a bond.

For starters, this is not investment advice, but one will always get compensated for taking the risk and investing in the market. Historical data shows that developed markets have given better inflation adjustment returns than any other asset class. One just needs to stay invested and not lose patience or get bogged down from the downturns of the market.