“Rupee at an all-time low”, “Rupee depreciating” etc. are some of the common headlines over the last couple of weeks. But is it really the case? Is Rupee (INR) depreciating at an alarming rate or is the Dollar (USD) simply appreciating at a faster pace? Let us look into some of the prevailing exchange rates.

If we look at the change in the exchange rate from 1st January 2022 to 27th June 2022, we notice that the Rupee has actually fared better than most of the other global currencies.

What has changed? Well for starters, the fear of recession has led to investors pulling out money from developing markets. Just to give an idea Foreign Investors have pulled out a sum of INR 46,000 crores so far in the month of June. The second factor that contributed to this rally was the recent rate hikes by Fed. The tightening of the monetary policy with a hike in interest rates made investing in the US highly lucrative. The strengthening of the USD is based on the expectations of a more aggressive U.S. monetary policy relative to the eurozone and Japan.

The market anticipates that there are going to be 10 additional interest rate hikes under the interest rate normalization program which will set the year-end Fed fund rate at 2.8%. In stark contrast, the market expects the European Central Bank rate hikes will lead to a fund rate of 25 bps

The Ukraine war has led to an increase in uncertainty for the Eurozone and additional sanctions on the import of oil and gas can push the Euro and Yen lower than the current level. In such a situation USD will maintain its status as a safe-haven currency

We expect the dollar to continue to benefit from its status as a safe haven for international investors and commercial interests, particularly considering the more precarious position of Europe’s economy. The U.S. dollar index (USDX) which measures the value of USD against a basket of foreign currencies is shown below.

The index was set up after the dissolution of the Bretton Woods Agreement and is maintained by the Intercontinental Exchange (ICE). The basket of foreign currencies consists of six currencies depicting the regions with whom the US has crucial trading ties. The currencies are euro, Swiss franc, Swedish krona, British pound, Japanese yen, and Canadian dollar. The index gives us a fair indication of the USD value in the global market. We can see that it is trading above 100.

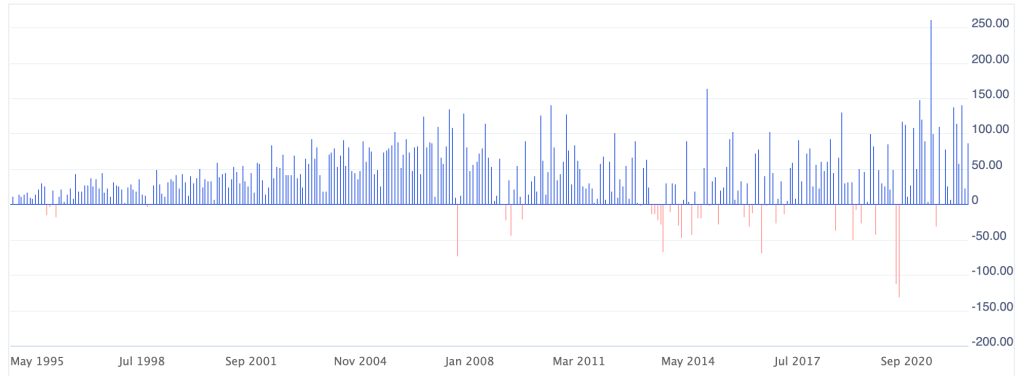

The Treasury International Capital (TIC) system shows that there has been a continuous inflow of long-term investments which shows the confidence of investors placed in the US’ recovery. We see that the investments tend to whither down during any crisis (may it be the 2008’s GFC or the 2020 pandemic). Reviving interest in US long-term assets will apply downward pressure on the long-term rates even as the rates will move higher due to inflation.

We have to accept that the USD has gained much more than anticipated which has led to the depreciation of other currencies. Yes, the INR is falling to all-time low values and imports will become dearer. But at the same time, we have to acknowledge that things could have been far worse. The road to recovery won’t be easy. Let’s see how things pan out..

1 thought on “Is the Rupee really depreciating at a rapid pace?”