Inflation and the depreciating rupee have hogged the front page of every newspaper in recent times. You can refer here to our earlier article on rupee deprecaition. We are all aware that inflation is rising and at the same time the rupee is falling, but should that be the case?

We are at one of those rare historical moments where the inflation in developed countries is more than in developing countries. As per the macroeconomics concept, inflation goes a long way in explaining the exchange rate of two currencies. So if a country (eg India) experiences higher inflation than another country (eg US) then the value of INR should decrease. That has been the pattern over the ages.

However, we see that the inflation in the US is higher than that in India and still the rupee is depreciating. What has changed?

For starters, inflation refers to the increase in the price of any product whereas the exchange rate is the price that can be used to trade products with other countries. In order to prevent arbitrage opportunities, the exchange rate should mimic the prices.

Historically the inflation in India has been higher compared to developed countries.

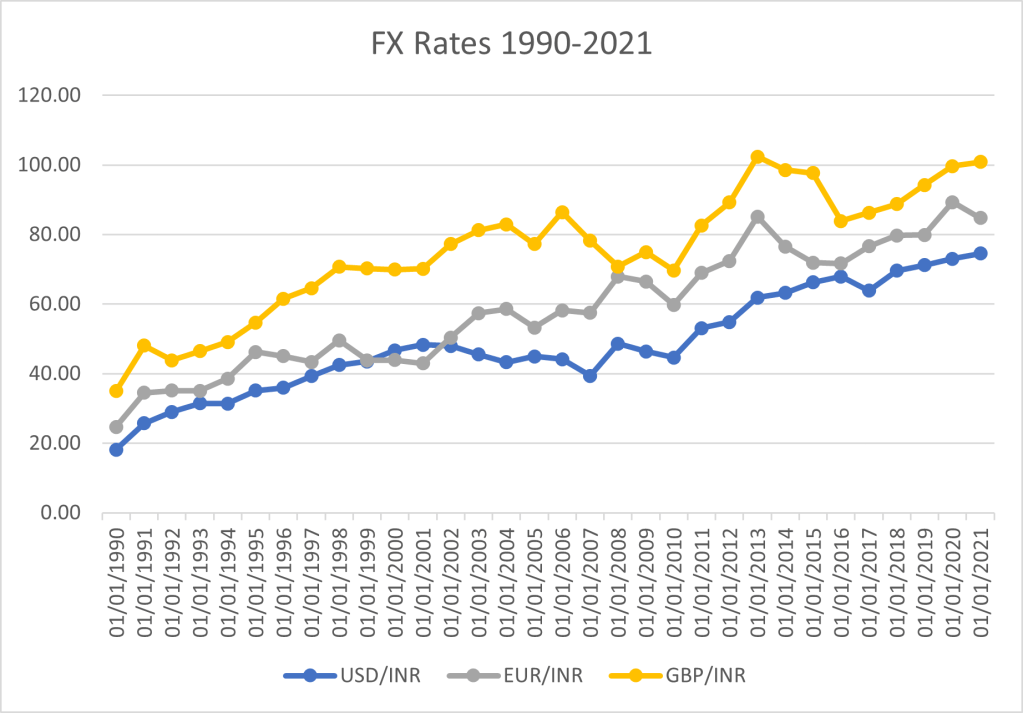

The higher inflation has resulted in a weaker rupee. As we can see the rupee kept on depreciating against the major currencies.

However, over the last few months, the inflation in India has been lower than the developed economies.

It resulted in the rupee getting stronger with respect to GBP and EUR. However, we see that rupee has depreciated against the USD.

Why is it so?

Well, the simple answer is that the USD is still perceived to be the global currency. Most of the trades are invoiced in USD. Currencies like Jordanian Dinar, Bahrain Dinar, Qatari Rial, and UAE Dirham are pegged to USD. as the fed increased rates, the global investors started pulling out funds from emerging markets and started investing in USD (refer to the article). This led to an increasing demand for USD which resulted in appreciation against all currencies. The RBI has tried it’s best to stop the depreciation by focusing on capital inflows and also trying to promote international trade in INR. They have also resorted to hikes in policy rates and selling off foreign exchange reserves to stem the flow. But the INR still continues to fall. A currency considered as global currency can certainly defy economic theories!