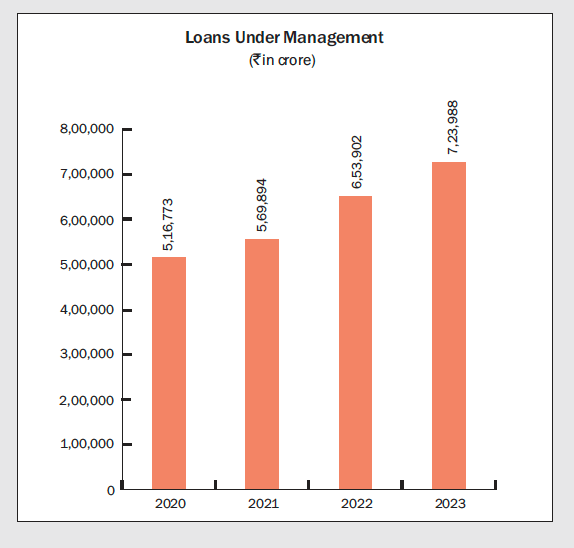

India’s home loan sector is proliferating due to affordable projects, higher income, and increasing penetration. HDFC Limited’s own loan portfolio has grown in the last few years.

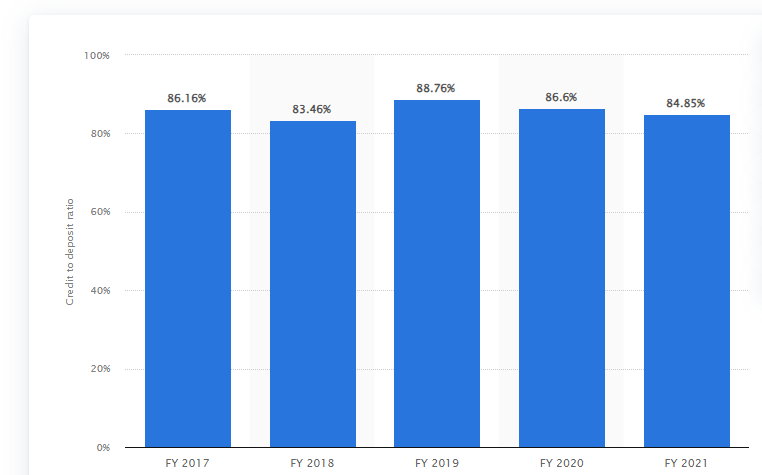

HDFC Limited has issued INR 2,603.98 billion worth of bonds which bears a weighted average yield to maturity of 7.78% and a weighted average coupon rate of 7.64%. Merging with HDFC Bank gives HDFC limited access to the CASA and time deposits of the banking division. This has grown quite significantly over the last few years.

This source of funds is comparatively cheap as well. The cost of deposits in FY 2021-22 was 3.56% and reduced from 4.15% in FY 2020-21. “Cost of Deposits is the ratio of interest expense on deposits to a daily average of total deposits”.

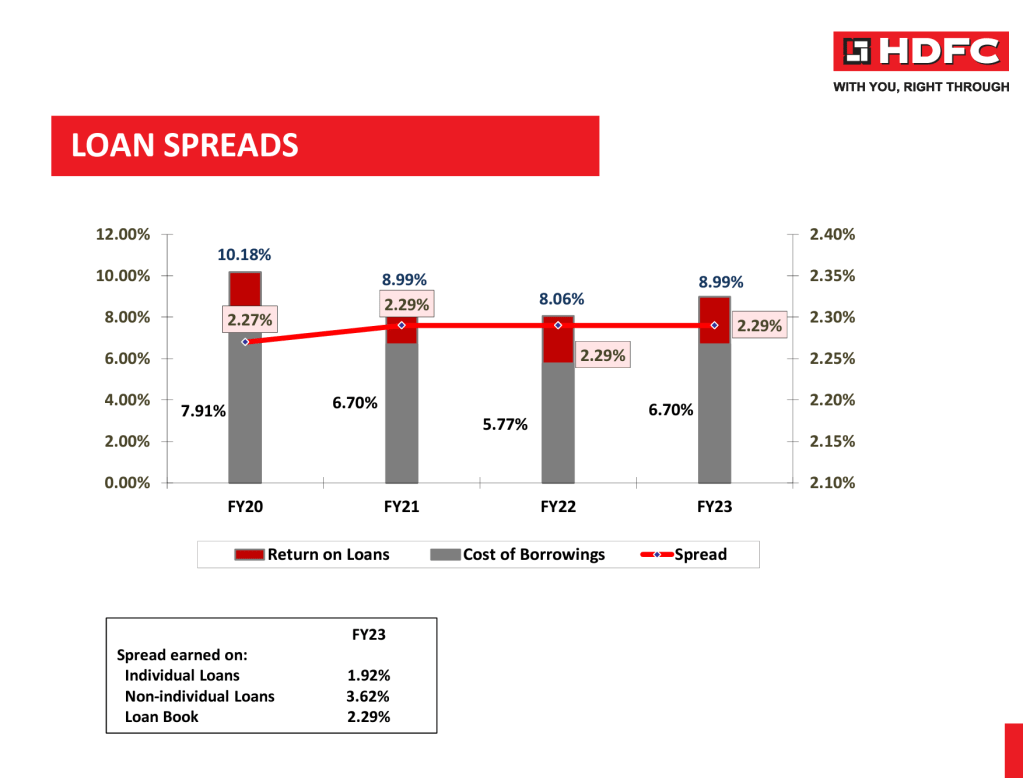

The spreads of the HDFC limited are shown below.

Needless to say that a cheaper source of funds for the home loan division will lead to higher margins and greater profit. Although HDFC Bank’s loan-to-deposit ratio is high a large chunk of the loan portfolio comprises home loans.

It would be interesting to see how things pan out after the merger especially the impact on the margins and growth of the loan books.