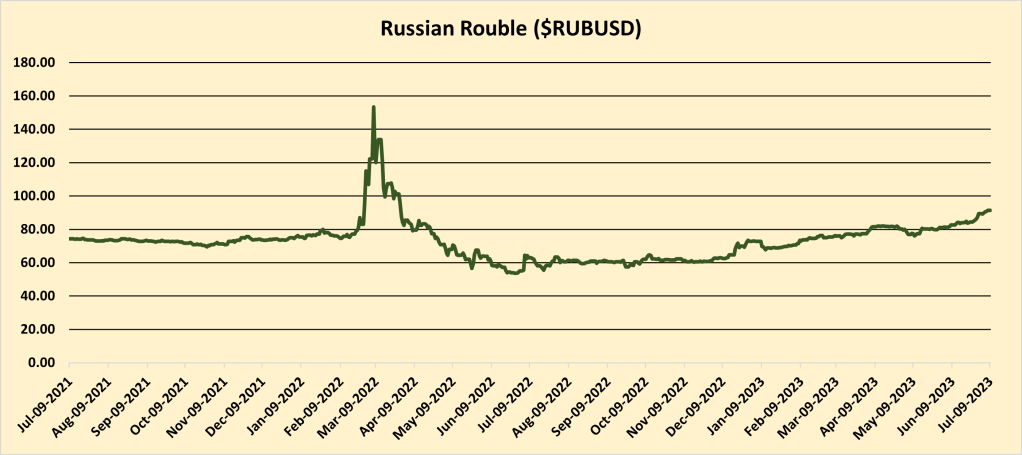

The Russian Rouble has performed better than expected for most of the past year. After plunging to an unprecedented low of 140 Roubles per dollar in the immediate aftermath of Ukraine’s invasion, it recovered to a high of 56 Rubles per dollar in April before stabilizing at about 60 Rubles for most of the past year. However, in recent months, the ruble has started steadily declining, falling to 70 Rubles per dollar in February and then 18 April before reaching an eight-year low of 95 Roubles per dollar in the past week after the Wagner’s attempted coup.

A little background: After Putin’s invasion of Ukraine, many analysts predicted that sanctions would be applied to the Russian economy. After all, these sanctions were unprecedented; they included freezing Russian Central Bank assets, expelling a number of Russian banks from Swift, and imposing individual sanctions on Russian Elites and even Putin himself. For the first few weeks, Russia’s economy appeared to be on the verge of collapse. Russia indefinitely shut down its stock market, and the ruble fell to an all-time low of 140 to the dollar Unfortunately for the West, the Rouble fared better than expected still nonetheless the economy contracted by more than 2% last year, according to official figures.

It reached a five-year high in early July 2022, peaking at roughly 57 Rubles per dollar, having returned to its pre-war level of 70 Rubles by April of last year. This wasn’t because people actually wanted rubles; rather, it was because Russia’s Central Bank had wisely raised interest rates from 9.5 to 20 percent, making it more attractive to hold rubles but almost guaranteeing a recession in the real economy. The apparent strength of the ruble became one of Putin’s favorite talking points, which he claimed was proof of the futility of the West’s sanctions foreign. due to the Kremlin’s strict capital controls, which included limiting who could trade Roubles on official exchanges, that were put in place to protect its currency restricting foreigners’ ability to sell their investments in Russia and requiring exporters to transfer 80 percent of their foreign cash balances into Roubles. When Russia started compelling European oil and gas importers to pay for their hydrocarbons in Rouble, this effectively became 100.

Basically, there are really just two reasons why the Rouble appreciated last year. Russia had plenty of foreign currency to protect the Rouble, thanks to astute central banking and the enormous demand for oil and gas, both of which surged in the immediate wake of Putin’s invasion.

However, over the past few months, the Rouble has been steadily losing value, which accelerated late last month. By January, the Rouble fell from its high of about 56 per dollar to its pre-war level of about 70 Rubles per dollar. In the months since, however, the Rouble has continued to lose value, reaching 80 Roubles per dollar in April and then falling to a new low of almost 95 Roubles per dollar this week. As a result, the Rouble has now become one of the worst-performing currencies in 2023.

The fall can be attributed to the following reasons. Firstly, the measures that the Central Bank put in place at the beginning of this year were only ever going to be temporary capital controls which became less effective over time as people and businesses found ways around them, and Russia’s Central Bank has cut rates from 21% to 7.5% which will have some effect on the Rouble.

Secondly, the decline in global hydrocarbon prices. As we already noted, Russia’s ability to defend the currency last year was largely due to the enormous sums of money it was earning from its oil and gas exports in the months following Putin’s invasion. From a pre-war average of around 20 euros per megawatt hour, European petrol prices soared to over 70 euros in March and then an all-time high of more than 300 euros in late August. Similar oil prices increased from around USD 80 per barrel at the beginning of the year to nearly USD 120 per barrel, an eight-year high, in the days following Putin’s invasion and lingered above USD 100 for the following few months, oil and petrol prices have fallen in recent months. Oil is currently trading at approximately USD 75 per barrel, while European gas characteristics are currently trading at about 35 Euros per megawatt hour, which is over the pre-war average but far below what it was last year. In addition, Russia is currently discounting its oil by about 20% due to the g7’s late-last-year-implemented oil price restriction. This resulted in lower hydrocarbon revenues and lower reserves to keep the Rouble afloat.

Thirdly the Wagner’s coup attempt. The Rouble has been steadily falling since January, but the rate of decline really picked up after the Wagner group’s attempted takeover. The day before the Wagner group’s coup, the Rouble was trading at about 81 Roubles to the dollar, but the day after it was already down to about 85, and it then quickly fell to a 15-month low of 94.5 Roubles to the dollar at the wee hours of Thursday morning. It is obvious that Russia’s domestic political crisis has spooked the market.

Although it won’t have much effect on te war given that Russia produces most of its weapon domestically and has reserve to sustain the war. A weaker currency means less purchasing power, which will make funding Russia’s war in Ukraine a little more challenging. It also runs the risk of stoking inflation, which has only recently started to decline in Russia. This is yet another blow to the much-touted idea of a BRICS currency.

It would be interesting to see how things unfolds in the coming months!!