The post covid low interest rate era led to excess liquidity and we saw many companies raise money in the equity market. “Tech” was the buzz word and it felt that just adding tech somewhere in the sales pitch would enhance the valuation manifolds.

“The performance of NATC stocks after their IPOs in 2021 has made investors rethink. They now lay greater importance on profitability, or at least a path to profitability in the near term,” Venkatraghavan S, managing director-investment banking, Equirus

“A number of NATCs which listed in the ‘Go-Go’ year of 2021 saw their stock price nose-dive post IPO due to global inflationary pressures, geo-political conflicts, and their own financial performance. Whilst several IPO-bound NATCs are waiting on the sidelines to go public in 2024, cash flow positive issuers will find the runway smoother for a successful listing,” Abhimanyu Bhattacharya, partner, Khaitan & Co.

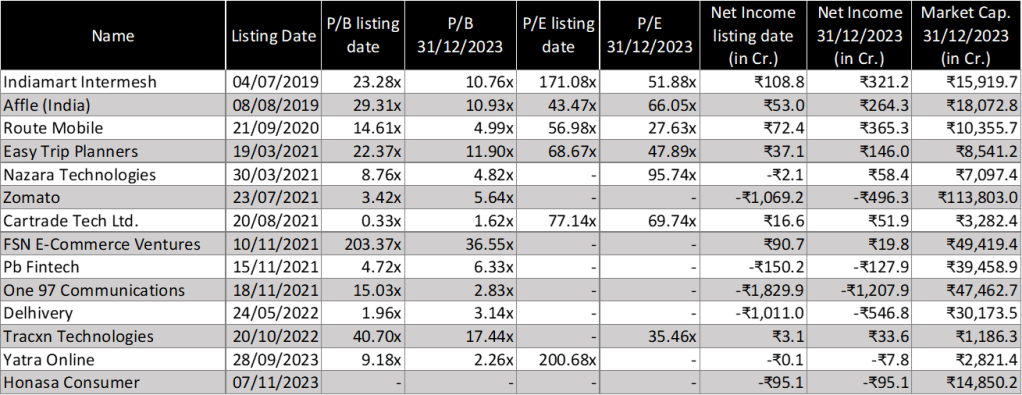

Let’s look at some of the key figures from the NATCO listings since 2019. The table below compares the adjusted issue price (adjusted for any subsequent splits and bonus issues) with the listed price and the trading price at year-end. We see a clear trend, the does that had the IPOs during the liquidity pump era saw the price plummet. This is not at all surprising given the premium these businesses had demanded during the period.

It’s interesting to see that most of these companies had negative net income during the IPO and they are yet to turn net income positive. The multiples that they commanded during the lPO were absurd, to say the least, and funnily enough they managed to get through. But the markets have realized that profitability is important, one can not burn a hole in the pocket for the sake of expansion. With funding winter, the market rectified and made it clear that unless and until the cost metrics are right, the business won’t be successful.

As India braces for more volatility ahead of the elections, it would be interesting to see how the investors and market react to new IPOs that operate on the burn it till you make it model!