We all know that Indian Foreign Exchange Reserves are at an all-time high (read here). What has led to the sudden increase in reserve? Well back in 2022, RBI had entered into a dollar Swap worth USD 5bn or INR 40,000 cr, where it sold dollars against INR. This was done to absorb liquidity from the market and curb inflation. The swap matured in March 2024, RBI could have rolled forward the swap, but it believes that the inflation has come down enough to settle the swap (read here). However, we see that the INR is at an all-time low (read here). But how does RBI fit into the exchange rate?

Well for starters let’s look into the various avenues through which the dollar enters the country. There are broadly three categories.

So what happens when there is an excess inflow of dollars?

But there is a thin line between maintaining the exchange rate and aiding inflation. Excess buying of the dollar can lead to an over-supply of INR in the market thereby making lending cheaper. Which in turn leads to higher demand for goods where the supply can’t keep pace thereby ending in inflationary conditions. In the case of a dollar outflow, the reverse happens.

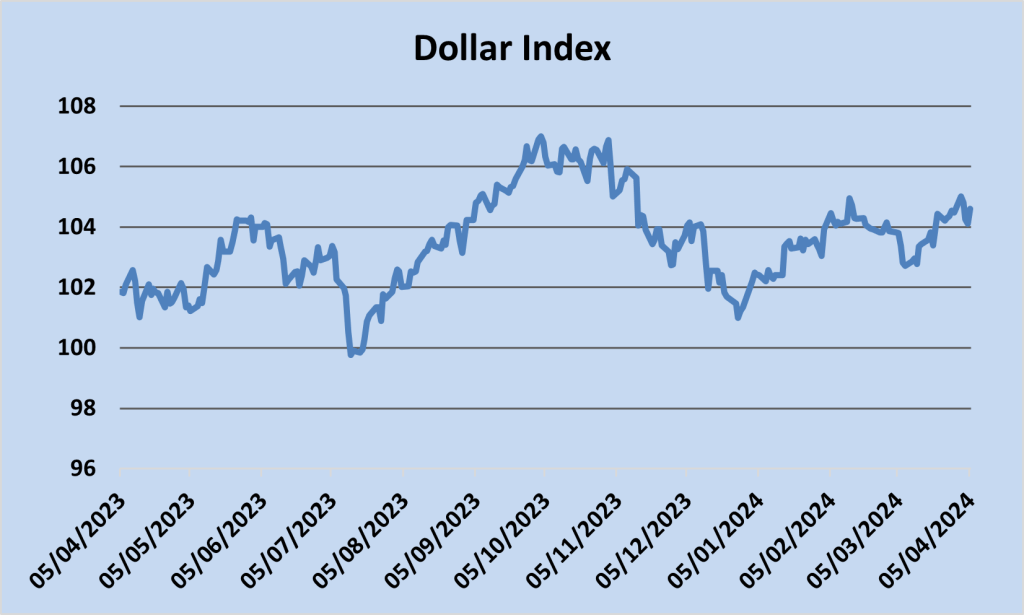

In the last year, we have seen movement in the Dollar Index. The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The Index goes up when the U.S. dollar gains “strength” when compared to other currencies (Wikipedia). Whereas the USD/INR rate has remained comparatively stable.

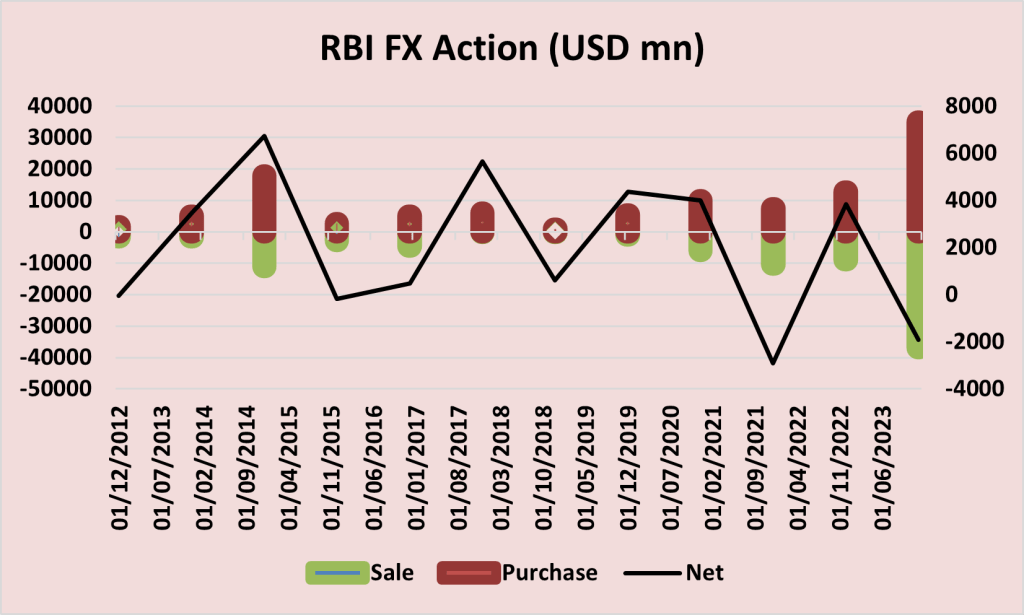

The FX purchase and sale data clearly indicates that RBI has been more active over the recent year.

It’s all hunky dory when there is stability and lower risk, but what happens when things take a down turn? Should RBI continue to keep the exchange rate constant or let markets decide the fate?