Date- 24th June 2020

Venue- Delhi

Event- Diesel sells at a price higher than Petrol !!

Crude Oil prices have been on the downslide & people expected the price of diesel and petrol to fall. Instead something else happened, we witnessed all time high diesel price. For the first time, petrol became cheaper than diesel, something unimaginable for in a country which is price sensitive and where people opt for diesel cars due to relatively cheaper fuel expense! Before we deep dive to the root cause, let us start with some facts.

India imports a basket of crude oil which is known as the “The Indian crude oil basket”. The basket is composed of 75.50% sour grade – Oman & Dubai average and 24.50% sweet grade – Brent (dated) crude oil. The price of crude oil is the weighted average of the daily price of the respective oil index forming part of the basket.

| 2000-2001 | $26.92 | |

| 2001-2002 | $22.55 | |

| 2002-2003 | $26.60 | |

| 2003-2004 | $27.98 | |

| 2004-2005 | $39.21 | |

| 2005-2006 | $55.72 | |

| 2006-2007 | $62.46 | |

| 2007-2008 | $79.25 | |

| 2008-2009 | $83.57 | |

| 2009-2010 | $69.76 | |

| 2010-2011 | $85.09 | |

| 2011-2012 | $111.89 | |

| 2012-2013 | $107.97 | |

| 2013-2014 | $105.52 | |

| 2014-2015 | $84.16 | |

| 2015-2016 | $46.17 | |

| 2016-2017 | $47.56 | |

| 2017-2018 | $56.43 | |

| 2018-2019 | $69.88 | |

| 2019-2020 | $60.47 | |

| 2020-2021 | $19.90* |

*Till April 2020

To give you an idea about the size of imports, let us look at the historic value.

| Year | Import Bill (in USD Billion) |

| 2019-20 | 102.2 |

| 2018-19 | 111.9 |

| 2017-18 | 87.8 |

| 2016-17 | 70.2 |

| 2015-16 | 63.9 |

| 2014-15 | 112.7 |

| 2013-14 | 144.3 |

With prices of crude oil being at all time low, it’s bizarre that the diesel price is so high. Things have to function rationally and this is something inexplicable. Let us try to understand why that is the case.

Like in any other manufacturing process, crude oil is just a raw material and not an end product. One can not simply import oil and start using it, it has to undergo additional refining. Crude oil isn’t the end product. It’s an intermediary that requires additional refining. The crude oil undergoes series of processes at a refinery and the end product is the consumable goods that we buy.

The cost of processing depends on the complexity of the process and is different for the various end products. Diesel has more carbon contents, is heavier and less volatile, thereby making it easier to refine. As a result of which, diesel prices tend to be slightly lower than that of petrol. Which is true for most of the countries in the world and not only in India. You have noticed the usage of the word “slightly” next to lower. Historically the prices of diesel, in India have been significantly lower and not just “slightly”. The reason behind this anomaly is the lopsided tax structure prevalent in India. Diesel is an industry fuel, used in transportation, railways etc whereas petrol is mostly used in personal vehicles. Government wants to keep inflation under control, hence traditionally diesel attracted lower taxes compared to petrol thereby making it way cheaper. Why is the trend reversing?

The answer is LOCKDOWN!!! Entities that are largely responsible for processing, refining and selling auto fuel are known as Oil Marketing Companies or OMCs. The nationwide lockdown has effected these companies, just to give some idea, in April, consumption of petrol reduced by nearly 60% and that of diesel by 55%. But these companies are high capex based, hence they were still incurring huge amount of fixed costs. The companies were still shipping crude oil, paying the salaries to their payroll, running the factories at reduced capacity, all these when the sales were really low.

But wait, these companies mean business and they are street smart. They had anticipated the sharp fall in the global crude oil prices and stopped revising prices after 16th March 2020. They wanted to take benefit of their lower cost of input by keeping the selling price constant and earning a higher margin. The benefit of the lower crude oil prices was not transferred to the end user/consumer.

On the other end of the coin, the government needed revenue. It had announced various measures of relief to cope with the pandemic and other disastrous events. It was already borrowing but the borrowing comes with a cost and higher the leverage the more costly the debt gets. It was in search of funds and they saw an opportunity in the fuel prices. The government increased the excise duty on petrol and diesel. It is really easy to do this, as the excise duty on oil is passed as a money bill and all one needs is a majority in the Lok Sabha.

Bear in mind that excise duty is an indirect tax levied on the manufacturer and need not be borne by the end customer, it is a tax on production and not on consumption, so there are two alternatives available. Either the OMCs can pay the amount from their own pocket or pass it on to the end consumer and collect it from them. Government had increased the excise duty by a record ₹10 per litre on petrol and ₹13 per litre on diesel, with the intention of raising ₹1.6 lakh crore in revenue. A news of increase in ₹1 per litre of petrol causes havoc, just imagine the situation if the OMCs had increased the price of petrol by ₹10 per litre overnight! So the OMCs decided to take the hit and not increase the prices.

Sounds contradicting right? because the price of petrol and diesel has increased since 16th March 2020 to 6th June 2020. The credit for the same goes to state governments. They too needed the funds and in search of additional revenue they increased the VAT on petrol and diesel. Unlike excise duty, VAT is based on consumption and hence needs to be collected from the end user. So any increase (within the time frame of 16th March 2020 – 6th June 2020) in the price of petrol and diesel can be attributed to the state governments.

Wait a minute, why the cut-off date of 6th June 2020? because the crude oil prices had started to recover, OMCs couldn’t afford to pay the taxes from their own pockets, margin was shrinking and they had to increase the price!! Just to give a brief idea, a computation published in the economictimes.

In Delhi dealers pay Rs 18.28 per litre for petrol, including the base price and freight. After levying VAT , excise and dealer commission, the retail price shoots up to Rs 71.26 for a litre. Similarly, for diesel, dealers pay Rs 18.78 a litre.

- Excise duty: On petrol, the duty levied is Rs 32.98 a litre, while on diesel it is Rs 31.83 per litre.

- VAT: It varies from state to state, with Madhya Pradesh, Kerala, Rajasthan, Karnataka levying over 30 per cent VAT — the highest among states.

- Dealer commission: Is different for petrol and diesel and varies a little with the location of fuel pumps, ranging from Rs 2-4/litre. In Delhi, the dealer commission is Rs 3.57 a litre, while on diesel it is Rs 2.5

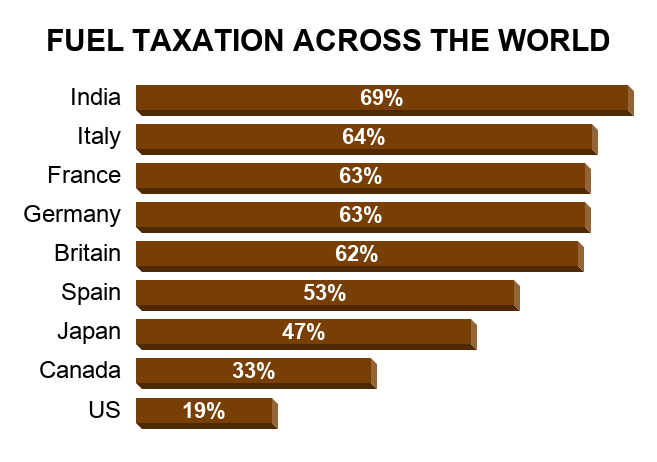

Taxes constitutes over 69% of the price — which happens to be the highest the world

Hope that helps you to understand the basic framework of fuel pricing and what factors have lead to sudden surge in the prices.

Very interesting explanation and data analysis of the matter that is bothering everyone right now, showes your deep understanding and study of every perspective.

LikeLike